Active vs. Passive Mutual Funds: Which Strategy Should You Choose?

Active vs. Passive mutual fund, the debate is not new.

“Urmila, what option is better according to you – an active mutual fund or a passive one?”, many clients have asked me the same question. And, I always respond by saying “The right choice depends on YOU – your goals, your risk appetite, and your patience.”

If there’s one thing I’ve learned after years of navigating the world of mutual funds, it’s this—no single strategy fits everyone. I’ve seen investors chase hot stocks, hoping for sky-high returns, only to end up disappointed. I’ve also seen those who quietly stuck to passive funds and built wealth over time, stress-free.

Today, let’s break down the concept of actively managed mutual funds and passively managed mutual funds. We will also discuss the strategy for choosing the right one for you.

What is Passive Mutual Fund?

We can understand passive mutual funds as the ‘autopilot’ of investing. These funds aim to mirror the performance of a benchmark index by holding the same stocks in the same proportion. There’s no fund manager making constant buy-and-sell decisions. It provides your funds just a steady ride that reflects the broader market.

Why Investors Like Passive Funds:

- Lower costs – Since there’s minimal buying and selling, expense ratios are low.

- Less risk – No stock picking means no risk of choosing the wrong ones.

- Market-matching returns – These funds don’t aim to outperform the market but simply track it.

- Ideal for long-term investors who prefer a hands-off approach.

For example, if you invest in the Nifty Small Cap 250 Index Fund, your portfolio will hold 250 stocks exactly as they are in the index. If these companies perform well, your fund will generate returns in line with the index. There’s no active decision-making; it simply follows the market.

Some common types of passive mutual funds include index funds, exchange-traded funds (ETFs), and fund-of-funds investing in ETFs.

What is Active Mutual Fund?

Active mutual funds, unlike passive, rely on a fund manager and a team of analysts trying to “beat the market.” They actively select stocks, predict trends, and make buy-sell decisions to maximize returns.

Why Some Investors Prefer Active Funds:

- Potential for higher returns – If the fund manager picks the right stocks, you could earn better-than-market returns.

- Flexibility – Active managers can adjust portfolios based on market conditions.

- Not tied to an index – There’s room for creativity and strategy in stock selection.

For instance, let’s say Hindustan Aeronautics Ltd receives a major defense contract. A skilled fund manager might recognize the growth potential and add it to the fund’s portfolio before the stock price surges. Similarly, if economic signals suggest a boom in IT stocks post a U.S. election, an active fund may increase its exposure to that sector to capture potential gains.

However, this comes with higher risks and costs due to frequent trading and management fees.

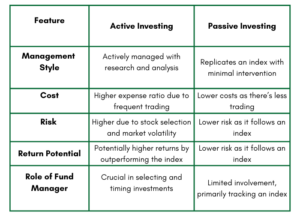

Active vs. Passive: Key Differences

How to Decide Between Active and Passive Funds

Before picking a strategy, consider these factors:

- Investment Goals: If you want the chance to outperform the market, and are ready to bear extra cost, go for active funds. If you prefer steady, market-matching returns at a lower cost, passive funds are a better fit.

- Risk Tolerance: Active funds come with higher risks due to stock selection and market swings. Passive funds are generally more stable.

- Cost Considerations: Active funds have higher fees because of frequent trading and research. Passive funds are more cost-effective.

Final Thoughts

At the end of the day, the best approach is the one that aligns with YOUR financial goals. If you enjoy market analysis and are comfortable with some risk, active funds may be exciting. But if you prefer a “set-it-and-forget-it” strategy, passive funds might be the way to go.

Many investors find a mix of both strategies works best—combining the potential upside of active funds with the stability of passive ones. If you’re unsure, speaking to a financial planner can help you design a portfolio that fits your needs.