Does your loan serve you or enslave you?

I read a quote that says, “Survival mode is supposed to be a phase that helps save your life. It is not meant to be how you live.” That’s how I ended up writing this blog.

The constant stressors of today’s life, such as work pressure, social expectations, and most importantly financial worries, can exacerbate survival instincts and contribute to damaged personal finances. I know I am still not clearly articulating, let me just get to the point. I am talking about Loans which are also called debts.

From a needle to a piece of land, we now live in a world where things are available to us in a few clicks. No doubt desire is what makes us human. Desire is a cause of multiple things like internal wishes, personal dreams, societal pressures, and lastly the most important comparison. Comparison is the most common thing that drives the desire of a human. We live in a society where things are compared with what you possess (for eg: a home), with what you show (for eg: a high-end car), and so on. I strongly feel that’s where the line between survival instinct and ego blurs.

Marketers often use instant gratification to get their products or services sold. I would like to add by saying instant gratification is there to satisfy our ego due to comparison & some obvious social factors.

When I say things are easily available in a few clicks I mean we tend to buy things considering the so-called “easy loan” or “easy EMI” options. We mostly think of availing things right now, we hardly think about the long-term implications or damages on our personal finances.

The above discussion was to enlighten us about the behavioral and the survival part of us that decides whether a loan will serve us or enslave us. I want us to also look at the informational part of it. What kinds of loans are available, the difference between asset and liability, Understanding the Tenure of a loan and its interest rate, and so on. This will be a long read but surely an interesting one.

Do you own Assets or Liabilities?

From a financial planner’s perspective, we first need to understand why we are taking out a loan. Is that an asset or liability? For example, if we buy an expensive luxury car, but the car is only used for personal use and there is no profit on that possession then it’s a liability. If you opt for a vehicle loan, you are taking a loan for a liability not serving any additional value. Also, car value depreciates from 10-20% every year. I don’t mean you don’t need a car, but it’s important to define why we need that.

If the same car is used to generate some direct or indirect income then you are taking a loan to generate assets out of it.

Type of loan

Loans can be in any form like credit card, personal loan, bank loan, EMI, and so on. Here we need to have a balance of everything in regard to the tenure of the loan and the interest we are paying. Every new loan taken needs to consider the overall ability to pay it back in the current time and the future.

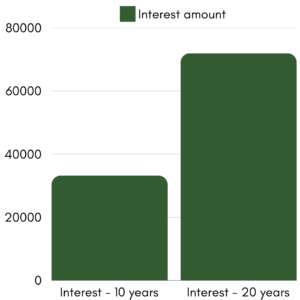

Tenure plays an important role because the more the tenure of the loan, it increases the more interest when we pay back. For eg, if we take a loan for ₹100000 at 6% interest for 10 years, we pay back ₹133225 and if we take ₹100000 at a 6% interest rate for 20 years, we pay back ₹171943. Hence ensure that you keep the down payment high and tenure low.

Loan on Investment Vs Personal Loan

Loan Against Securities (LAS):

- LAS provides individuals with the flexibility to access funds for a variety of purposes.

- It can fund business expansion, achieve personal financial goals, or address unexpected expenses.

Personal Loans (PL):

- PL caters to a diverse range of personal financial needs, making it a versatile borrowing option.

- Individuals can utilize Personal Loans for consolidating debts, covering medical expenses, planning dream vacations, or managing wedding costs.

In summary, while Loan Against Securities offers flexibility for different financial needs, Personal Loans cater to a wide range of personal financial requirements, making them suitable for different purposes. Assessing your specific financial goals and borrowing needs can help determine which option aligns best with your circumstances.

When deciding between a Loan Against Securities and a Personal Loan, several factors come into play to make an informed choice:

Availability of Collateral:

- Loan Against Securities involves pledging your investments like Debentures, shares, bonds, or mutual funds as collateral, restricting your ability to sell them.

- Personal Loans, on the other hand, do not require collateral.

- Opt for a Loan Against Securities if you have substantial investments and need a higher loan amount.

Cost Implications:

- Loan Against Securities (12% to 15%) often offers lower interest rates compared to Personal Loans (10% to 34%).

- This can lead to reduced overall borrowing costs, making it a more cost-effective option.

Emergency Situations and Investment Preservation:

- During emergencies, consider a Loan Against Securities to access funds without liquidating your investments.

- This approach allows you to retain the growth potential of your investments.

Your DTI (Debt to income ratio) should not cross 30 to 35%

The debt-to-income (DTI) ratio is a measure used by lenders to assess how much of your monthly income goes toward paying off debts.

For example, if your gross monthly income is ₹50,000 and your total monthly debt payments amount to ₹15,000, your DTI ratio would be calculated as (₹15,000 / ₹50,000) * 100 = 30%. Lenders typically prefer DTI ratios below 36%, with 43% being the highest allowable for mortgage qualification. A lower DTI ratio indicates that you have more income available to cover your debts, making you a more appealing borrower to lenders.

The biggest human behavioral enemy i.e Impulse buying

We should stay away from this to check whether we really need the thing at the moment we desire. To validate, keep the things you want in the shopping cart for 15-20 days and then check whether you still feel the need or it was just a strong desire at that moment to have it but it’s actually of less or no use.

When we get something for free or at an additional discount, we are kind of sold to it. But the fact remains the same, nothing is for free, even your hard-earned money is not for free, you have to pay the price for that, not in monetary terms but by giving up your precious time, energy, and efforts.

We often keep getting a “Free loan on investment” offer. We keep taking it because we think it’s for free. We tend to forget that our investments are mortgaged against the loan. The best suggestion would be to avoid these kinds of loans as investments are something built into your personal finances and mortgaging them is as good as risking to lose your hard-earned money. Always check your cash flow first before opting for such loans.

In the end, I would say, it is important to keep a check on our impulses and also read the terms and conditions before taking a loan or EMI. Nothing is more important than our health and sleep, if the loan is spoiling either of it, it is enslaving you and probably will disturb you emotionally in the long run. Stay informed, and make a wise decision.