5 stock market mistakes that retail investors should avoid

According to a recent study of Indian Stock Markets, retail investors owned 9.7% of companies listed on NSE in December 2021. It was 8.4 % in December 2019. Since the pandemic, there has been a huge rise in Demat account holders in India. With the rise of retail investors, the chances of losing money in the stock market also have increased due to multiple reasons and mistakes made by investors.

We choose to discuss this to ensure that we learn from others’ mistakes and it helps us to be aware of them.

As rightly said by Napoleon –

“A genius is a man who can do the average thing even when everyone else around him is losing his mind”

Let’s look into some of the mistakes that a retail investor usually makes and let’s learn from them –

Half knowledge is dangerous:

Our basic instinct, when retail investing, is to trust professionals. For the most part, that’s the right way to go about investing, but retail investors often forget to do research before making decisions related to money. We have experienced this situation with many of our clients who don’t know how the whole stock market system works. With half the knowledge about the retail investing process and a desperation to make profits, they lose a lot. Not just financially but emotionally too. Knowing the meaning of terms like profit, risk, loss, and other emotional aspects attached to investing would be a much better process for making investment decisions. In the end, we must aim to be more responsible when we invest our money

With this in mind, let’s look into some of the mistakes that retail investors make and learn from them.

A shortcut is not possible

We can’t escape the need to learn and apply our learnings when it comes to retail investing. The most common mistake that most new investors tend to make is they want to enter the stock market without the help of stock tips. Fundamental and technical research-based stock picking is a long and time-consuming process, so doing that is usually avoided by investors. Indirectly, this shows a behavior pattern: the more one desires to take shortcuts toward earning money through retail investment, the faster one tends to take unclear decisions.

For example, inexperienced retail investors tend to enter at the wrong time in buying the stock and then exit at an even worse time, which leads to losses. Knowing the right entry-level and exit-level can help you earn profits while buying or selling stocks.

Moreover, there are many investors who always show themselves as brave trader or investor under the influence of many emotions like ego, fear, self-doubt, etc. At times we don’t know what our risk capacity is and when to stop loss and walk away. So it is important to know our risk appetite and then pick the trades in the stock market. If this is done properly one can save losses up to a great extent within one’s own limits.

Catching the wrong train

There is a dialogue from my favourite Bollywood actor Paresh Rawal, “To stop the train, pull the chain” but the question always arises whether it is the right train. Let me simplify this further. Investors many times tend to enter at the wrong time in buying the stock and then exit at an even worse time, which leads to losses. Knowing the right entry-level and exit-level can help you earn profits while buying or selling stocks.

It is not necessary to be brave

There are many investors who always show themselves as brave trader or investor under the influence of many emotions like Ego, fear, self-doubt, etc. At times we don’t know what our risk capacity is and when to stop loss and walk away. So it is important to know our risk appetite and then pick the trades in the stock market. If this is done properly one can save losses up to a great extent within one’s own limits.

Penny stock is my favourite

Penny stocks are the most lucrative options which catch the eye of new investors in the stock market. Even Google search results are high about penny stocks.

What is a penny stock?

Often, retail investors are attracted to penny stocks. Penny stocks are those stocks that can be bought and sold at a very low price, have very low market capitalization, and are usually listed on a smaller exchange. You would see most stock picks that are bought or sold are in bulk here as prices start below ₹10 and go up to ₹50. We need to know the two important aspects of penny stocks: they are very speculative and highly risky in nature. This happens mostly because of the following reasons:

- The number of shareholders is low

- Larger bids

- Limited amount of information disclosed by companies

Research says that 80 to 90 % of penny stocks are not appropriate in nature due to multiple reasons of the few we have mentioned above.

Here I am not against penny stocks. But being heavily dependent on the same is a big mistake an investor can ever make. You can invest a small portion of your income in penny stocks.

After knowing the mistakes to avoid, learning the basics of stock picking is equally important. Let’s dive deep into the steps of selecting the right stock:

Observing every product around you:

This is the most important step in picking the right stock. There are a number of items, from toothpaste to bedsheets, which we use daily. For eg. Toothpaste is used daily. In India toothpaste is majorly associated with Colgate and you can find its share price by the stock name (Colgate-Palmolive)

Similarly, there would be 25-30 such daily used items, or probably more, to whom you are regular and loyal customers directly or indirectly. Make a list of all the items. Know the relevant brand and check if those companies are listed in the stock market.

Time to see their chart:

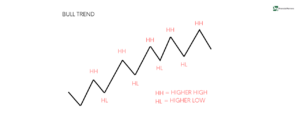

The above chart shows a Bull trend. This means every higher high is on the upper levels compared to their last higher high and the same trend with Higher lows. If you see that a stock is following this trendline then it’s a good stock pick. As we can see a consistent growth of the stock

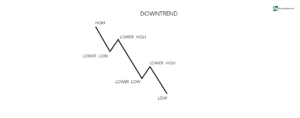

If you see a particular stock going consistently low then it lasts a lower high and the same with the last lower low, that stock is not a good pick for you.

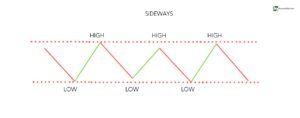

If the stock is following a trend where the High and low are consistently on the same level, you can wait and observe the stock. You can enter once it breaks the trend and follows the first trend which I showed you (Higher highs and Higher lows).

But this is not all that we need to know, this is just the tip of the iceberg.

Annual Reports of the company

Go to the annual reports and see if ROE & ROCE is greater than 15, if it’s consistent & greater than 15 then you can consider that 5% of investors will not lose money and have a probability of making some profits.

As I said these are the basics of stock picking one must know to be an Informed retail investor.

So to conclude this, I would say equity is not always about earning money in a short period of time. It is more about being patient and taking the right decision at the right time. It is always better to know your risk appetite and capacity before entering the stock market.

Rest you can surely email us your queries. I can answer the same in my upcoming blogs